Hurricane Season is Here – Stay Safe & Follow Waste Guidelines

As we enter peak hurricane season, your safety is our top priority. Please review the following waste collection guidelines to help us serve you efficiently after a storm:

🗑️ First Week After the Storm

- Priority Collection: We focus on removing perishable waste (e.g., spoiled food) due to power outages.

- Regular Trash Pickup: Resumes as conditions allow.

- Lawn Waste: Temporarily suspended during the emergency phase.

🌿 After the Emergency Phase

- Grass Clippings: Use clear or brown paper bags (recommended, not required).

- Household Trash: Use white bags (recommended, not required).

- Important: Keep all bags separate from storm debris. (recommended to be in black bags)

🌳 What Counts as Storm Debris?

Storm debris includes materials from hurricanes, floods, or windstorms, such as:

- Fallen trees, branches, and leaves

- Damaged fences, roofing, or water-damaged household items

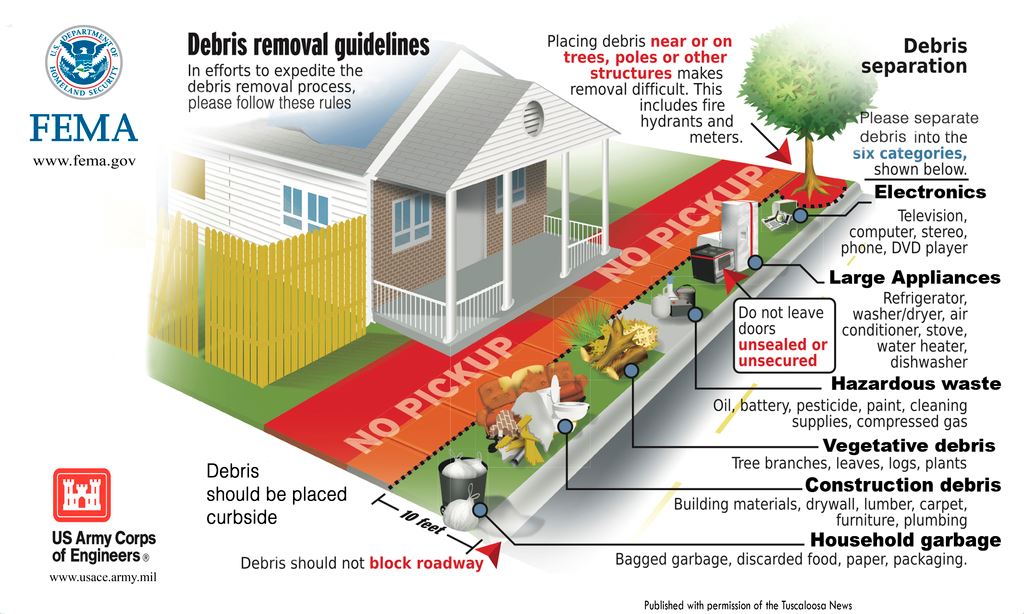

🚧 How to Prepare Storm Debris

- Place storm debris at the curb, separate from regular trash.

- Refer to the diagram (see picture) for proper placement.

⚠️ Important Reminders

- Storm debris and construction/remodeling waste are not included in standard trash service.

- For full details, visit: www.best-trash.com